CARES Act Relief 2.0

November - 19 - 2020

11/04/2020

New CARES Act Relief Dollars!

Cuyahoga County announced a new program on Wednesday. The new program run by CHN Housing Partners will be giving out $2 million dollars in utility assistance. This is in addition to the rent relief and utility assistance programs previously announced late last month. Click here for the full article.

10/28/2020

On Monday, October 26th, the State of Ohio approved additional CARES Act funding. Included in that funding is some helpful financial assistance for both low-income families and small businesses impacted by Covid-19.

- $125 million for small businesses (25 or fewer employees)

- $50 million for rent/mortgage, water, and sewer bill assistance.

- $38.7 million for the Bar and Restaurant Assistance Fund.

Click the link to the full article for more details.

https://mailchi.mp/3f1f017efd1f/new-cares-act-assistance-programs?e=[UNIQID]

Workers Self Service User Guide To Unemployment Claims.

May - 03 - 2020

Here is a comprehensive guide to help you understand and properly file for unemployment. We suggest you read this guide before filing your claim, as doing so will prevent many common issues that claimants are running into.

https://unemployment.ohio.gov/PDF/NEW_Workers_Self-Service_User_Guide.pdf

Unemployment, Stimulus and County program Updates -5/1/20

May - 01 - 2020

The Gesher Newsletter is a great resource to find out important information that you need to know regarding unemployment, stimulus payments, Medicaid, SNAP, WIC, and other updates. Read it here

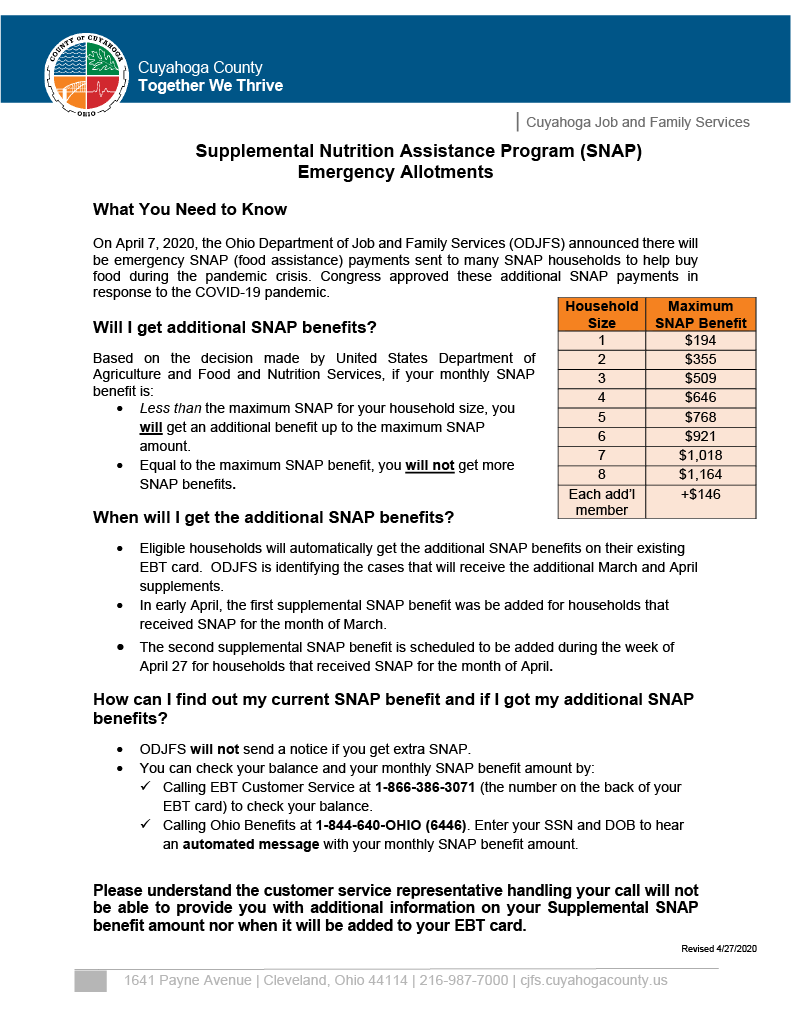

Emergency SNAP Allotments

April - 29 - 2020

Congress has approved additional SNAP benefits for those not yet currently making the maximum monthly amount for their household size. Currently, this was approved for the months of March, April, and May. Decisions will be made regarding further payments. Here is what you need to know:

This is courtesy of CJFS

Unemployment Agency Contact List by location and Social Security#

April - 23 - 2020

Ohio JFS which handles the processing of unemployment applications has divided the processing of applications by location, based on applicant social security numbers. This set up can significantly ease the application process for applicants by allowing them to call their assigned center hotline in addition to the standard 1-877-644-6562 number.

Here is a list of locations and phone numbers by social security # range. Additionally, you can fax correspondence to the central fax number 1-614-466-7449.

| Social Security # Range (based on last 4 digits) | Location | Phone Number |

| 0000-0765 | Cleveland Adjudication Center | 1-866-576-0006 |

| 0766-1942 | Akron UI Delivery Center | 1-866-768-0022 |

| 1943-2649 | Lorain UI Delivery Center | 1-866-849-0029 |

| 2650-4121 | Toledo UI Delivery Center | 1-800-589-2799 |

| 4122-4710 | Chillicothe Adjudication Center | 1-866-244-0399 |

| 4711-6005 | Marietta Adjudication Center | 1-866-867-0044 |

| 6006-7182 | Youngstown Adjudication Center | 1-866-221-0558 |

| 7183-7477 | Dayton UI Delivery Center | 1-866-541-0187 |

| 7478-7701 | Interstate and Federal | 1-866-217-0008 |

| 7702-8360 | Columbus UI Delivery Center | 1-866-217-0008 |

| 8361-9999 | Lima Adjudication Center | 1-866-272-0118 |

| 0000-9999 | Columbus Adjudication Center (Interstate & Federal Claims) | Columbus Adjudication Center (Interstate & Federal Claims) |

Covid19 Stimulus Package FAQ

March - 27 - 2020

Here’s an overview from the NY Times of what the stimulus package will look like and some FAQ’s. We hope to update this as we learn more.

Stimulus Payments How large would the payments be?

Most adults would get $1,200, although some would get less. For every child age 16 or under, the payment would be an additional $500.

How many payments would there be?

Just one. Future bills could order up additional payments, though.

How do I know if I will get the full amount?

It depends on your income. Single adults with Social Security numbers who are United States residents and have an adjusted gross income of $75,000 or less would get the full amount. Married couples with no children earning $150,000 or less would receive a total of $2,400. And someone filing as head of household would get the full payment if they earn $112,500 or less. Above those income figures, the payment decreases until it stops altogether for single people earning $99,000 or married people earning $198,000. In any given family and in most instances, everyone must have a valid Social Security number. There is an exception for members of the military. You can find your adjusted gross income on line 8b of the 2019 1040 federal tax return.

What year’s income should I be looking at?

2019. If you haven’t prepared a tax return yet, you can use your 2018 return. If you haven’t filed that yet, you can use a 2019 Social Security statement showing your income.

What if my recent income made me ineligible, but I anticipate being eligible because of a loss of income in 2020?

Do I get a payment? The bill does not appear to help people in that circumstance, but there are many other provisions in the legislation. You may be able to file for unemployment or for one of the new loans for small business owners or sole proprietors.

Would I have to apply to receive a payment?

No. If the Internal Revenue Service already has your bank account information, it would transfer the money to you via direct deposit based on the recent income-tax figures it already has.

When would they arrive?

Treasury Secretary Steven Mnuchin said that he expected most people to get their payments within three weeks.

If my payment doesn’t come soon, how can I be sure that it wasn’t misdirected?

According to the bill, you would get a paper notice in the mail no later than a few weeks after your payment has been disbursed. That notice would contain information about where the payment ended up and in what form it was made. If you couldn’t locate the payment at that point, it would be time to contact the I.R.S. using the information on the notice.

What if I haven’t filed tax returns recently, would that affect my ability to receive a payment?

It could. File a return immediately, at least for 2018, according to the I.R.S. website. “Those without 2018 tax filings on record could potentially affect mailings of stimulus checks,” the site says. If you’re worried about money that you owe that you cannot pay, the I.R.S. recommends consulting a tax professional who can help you request an alternative payment plan or some other resolution.

Would most people who are receiving Social Security retirement and disability payments each month also get a stimulus payment?

Yes. Would eligible unemployed people get these stimulus payments? Veterans? Yes and yes.

If my income tax refunds are currently being garnished because of a student loan default, would this payment be garnished as well?

No.

Unemployment Benefits:

Who would be covered by the expanded program?

The new bill would wrap in far more workers than are usually eligible for unemployment benefits, including self-employed people and part-time workers.

The bottom-line: Those who are unemployed, partially unemployed or who cannot work for a wide variety of coronavirus related reasons would be more likely to receive benefits.

How much would I receive?

It depends on your state. Benefits would be expanded in a bid to replace the average worker’s paycheck, explained Andrew Stettner, a senior fellow at the Century Foundation, a public policy research group. The average worker earns about $1,000 a week, and unemployment benefits often replace roughly 40 to 45 percent of that. The expansion would pay an extra amount to fill the gap. Under the plan, eligible workers would get an extra $600 per week on top of their state benefit. But some states are more generous than others. According to the Century Foundation, the maximum weekly benefit in Alabama is $265, but it’s $450 in California and $681 in New Jersey. So let’s say a worker was making $1,100 per week in New York; she’d be eligible for the maximum state unemployment benefit of $435 per week. Under the new program, she gets an additional $600 of federal pandemic unemployment compensation, for a total of $1,035, or nearly all of her original paycheck. States have the option of providing the entire amount in one payment or sending the extra portion separately. But it must all be done on the same weekly basis.

Are gig workers, freelancers and independent contractors covered in the bill?

Yes, self-employed people would be newly eligible for unemployment benefits. Benefit amounts would be calculated based on previous income, using a formula from the Disaster Unemployment Assistance program, according to a congressional aide. Self-employed workers would also be eligible for the additional $600 weekly benefit provided by the federal government.

What if I’m a part-time worker who lost their job because of a coronavirus reason, but my state doesn’t cover part-time workers. Would I still be eligible?

Yes. Part-time workers would be eligible for benefits, but the benefit amount and how long benefits would last depend on your state. They would also be eligible for the additional $600 weekly benefit.

What if I’ve been diagnosed with Covid-19 or I need to care for a family member who has?

If you’ve been diagnosed, are experiencing symptoms or are seeking a diagnosis — and you’re unemployed, partially unemployed or cannot work as a result — you would be covered. The same goes if you must care for a member of your family or household who has received a diagnosis.

What if my child’s school or day care shut down?

If you rely on a school, day care or another facility to care for a child, elderly parent or another household member so that you can work — and that facility has been shut down because of coronavirus — you would be eligible.

What if I’ve been advised by a health care provider to quarantine myself because of exposure to coronavirus? And what about broader orders to stay home?

People who must self-quarantine would be covered. The legislation also says that individuals who are unable to get to work because of a quarantine imposed as a result of the outbreak would also be eligible.

I was about to start a new job and now can’t get there because of an outbreak.

You’d be eligible for benefits. You would also be covered if you were immediately laid off from a new job and did not have a sufficient work history to qualify for benefits under normal circumstances.

I had to quit my job as a direct result of coronavirus. Would I be eligible to apply for benefits?

It depends. Let’s say your employer didn’t lay you off but you had to quit because of a quarantine recommended by a health care provider, or because your child’s day care closed and you’re the primary caregiver. Situations like that are covered. But this provision wasn’t intended to cover people who quit (or want to quit) because they fear that continuing to work puts them at risk of contracting coronavirus, according to congressional aides.

My employer shut down my workplace because of coronavirus. Would I be eligible?

Yes. If you are unemployed, partially unemployed or unable to work because your employer closed down, you would be covered under the bill. The breadwinner of my household has died as a result of coronavirus.

I relied on that person for income, and I’m not working. Would that be covered?

Yes.

Who would the bill leave out?

Workers who are able to work from home, and those receiving paid sick leave or paid family leave would not be covered. New entrants to the work force who cannot find jobs would also be ineligible.

How long would the payments last?

Many states already provide 26 weeks of benefits, though some states have trimmed that back while others provide a sliding scale tied to unemployment levels. The bill would provide all eligible workers with an additional 13 weeks. So participants in states with 26 weeks would be eligible for a total of 39 weeks. The total amount cannot exceed 39 weeks, but it may be shorter in certain states. The extra $600 payment would last for up to four months, covering weeks of unemployment ending July 31.

How long would the broader program last?

Expanded coverage would be available to workers who were newly eligible for unemployment benefits for weeks starting on Jan. 27, 2020 and through Dec. 31, 2020.

My unemployment recently ran out — could I sign up again?

Yes. If you’ve exhausted your benefits, eligible workers could generally reapply. But how much you would get and for how long would depend on the state where you worked. Everyone would get at least another 13 weeks, along with the extra $600 payment.

Would this income disqualify me from any other programs?

Maybe. The additional $600 benefit would count as income when determining eligibility for means-tested programs, except for Medicaid and the Children’s Health Insurance Program, known as CHIP.

How long would I need to wait for benefits?

States have been incentivized to waive the one-week waiting period, but it’s unclear how long it would take to process claims — especially with state offices so strained by a flood of claims.

Student loan relief

March - 23 - 2020

From the Department of Education:

WASHINGTON — U.S. Secretary of Education Betsy DeVos announced today that the office of Federal Student Aid is executing on President Donald J. Trump’s promise to provide student loan relief to tens of millions of borrowers during the COVID-19 national emergency.

All borrowers with federally held student loans will automatically have their interest rates set to 0% for a period of at least 60 days. In addition, each of these borrowers will have the option to suspend their payments for at least two months to allow them greater flexibility during the national emergency. This will allow borrowers to temporarily stop their payments without worrying about accruing interest.

“These are anxious times, particularly for students and families whose educations, careers, and lives have been disrupted,” said Secretary DeVos. “Right now, everyone should be focused on staying safe and healthy, not worrying about their student loan balance growing. I commend President Trump for his quick action on this issue, and I hope it provides meaningful help and peace of mind to those in need.”

Secretary DeVos has directed all federal student loan servicers to grant an administrative forbearance to any borrower with a federally held loan who requests one. The forbearance will be in effect for a period of at least 60 days, beginning on March 13, 2020. To request this forbearance, borrowers should contact their loan servicer online or by phone. The Secretary has also authorized an automatic suspension of payments for any borrower more than 31 days delinquent as of March 13, 2020, or who becomes more than 31 days delinquent, essentially giving borrowers a safety net during the national emergency.

Some borrowers may want to continue making payments, like those seeking Public Service Loan Forgiveness (PSLF) or those enrolled in a repayment plan with a manageable monthly payment. For borrowers continuing to make payments, the full amount of their payment will be applied to the principal amount of their loan once all interest accrued prior to the president’s March 13 announcement is paid. The Department will work closely with Congress to ensure all student borrowers, including those in income driven repayment plans, receive needed support during this emergency.

Any borrower who has experienced a change in income can contact their loan servicer to discuss lowering their monthly payment.

Visit StudentAid.gov/coronavirus for forthcoming details. For more information on all the efforts the Department is taking to address the COVID-19 national emergency, visit ed.gov/coronavirus.

As posted from the OAF Website:

COVID-19 RESOURCES **As of 5:00pm March 19th 2020** Advocates for Ohio’s Future and our partners want to make sure leaders know of and fix problems with the health care system as they address the Coronavirus (COVID-19). We want to understand and share as many people’s experiences and challenges so that leaders make helpful changes. Let us know your story and let your friends know to share theirs so we can give leaders a real-life view of the problems by completing and sharing this short survey

For updated public health information and resources specific to COVID-19, visit www.coronavirus.ohio.gov The Ohio Department of Health opened a call center to answer questions from the public regarding coronavirus (COVID-19). The call center will be open 7 days a week from 9:00 a.m. to 8:00 p.m. and can be reached at 1-833-4-ASK-ODH (1-833-427-5634)

Unemployment Insurance Benefits – If you have been requested by a medical professional, local health authority, or employer to be isolated or quarantined as a consequence of COVID-19, or have been laid off due to the lack of production caused by the coronavirus, you may file for unemployment benefits online at https://unemployment.cmt.ohio.gov/cmtview/ or by calling 1-877-644-6562. More Questions? Please visit Ohio Jobs and Family Services’ Coronavirus and Unemployment Insurance Benefits website for more information.

Health Care – If you do not have health care coverage or have lost it, you may be able to get affordable coverage through Medicaid or the Marketplace. Check first to see if you qualify for Medicaid at https://benefits.ohio.gov/. If you have changed or lost your job, you may be able to get affordable coverage through the Marketplace at https://www.healthcare.gov/screener/ Patients who need hospital care, but are unable to pay for it, may be eligible for free or reduced fee care at Ohio hospitals through the Hospital Care Assurance Program (HCAP). Applications for HCAP are accepted by the hospital where care was received, and patients seeking HCAP assistance should contact their hospital’s billing department for application instructions. There are a few resources for assistance with prescription costs. See these resources here http://uhcanohio.org/rxassistance/

Child Support – If you are having problems paying child support or you need additional child support, contact your county child support enforcement agency (CSEA). The CSEA will consider your case and present a recommendation for a possible adjustment. The amount could go up, go down or stay the same. To find the CSEA in your county, call (800) 686-1556 toll-free or visit jfs.ohio.gov/County.

Cash Assistance – You can apply for cash assistance online by going to Benefits.Ohio.gov or by filling out a “Request for Cash, Food and Medical Assistance” form and submitting it to your county department of job and family services. Ohio counties are waiving various work and community engagement requirements and granting good cause exemptions in light of the pandemic.

Child Care – ODJFS offers financial assistance to help eligible parents pay for child care while they work. Call your county department of job and family services. For more information, go to jfs.ohio.gov/factsheets/ChildCare.pdf or call (877) 852-0010

Food – You can apply for food assistance online at Benefits.Ohio.gov To be eligible for food assistance through the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps), your family income cannot exceed 130 percent of the federal poverty guidelines. You can check your eligibility by calling your county department of job and family services. More information about the program is available at jfs.ohio.gov/factsheets/foodassistance.pdf.

You may be eligible for The Emergency Food Assistance Program (TEFAP), which is distributed through local nonprofit agencies, such as food pantries. To be eligible for TEFAP, your family income must be below 200 percent of the federal poverty guidelines. To find a local food bank, visit ohiofoodbanks.org/coronavirus.

Pregnant women and children may also get food from WIC. You can apply by printing out a WIC Program Application and mailing it to the WIC clinic in your area. Please note that you must schedule an appointment at the clinic, too. To find a WIC clinic near you, please click WIC Clinic Directory or call 1- 800-755-GROW (4769).

Food and Nutrition Assistance for Children – The Ohio Department of Education has created a website to support whole-child nutrition at education.ohio.gov. Refer to the map and map site key at for available meal service in your area. Contact your school or district for details about their meal programs.

Older Adults – You can find your Local Area Agency on Aging by going to http://ohioaging.org or calling 1- 866-243-5678 to be connected to the area agency on aging serving your community.

Local Assistance – Dial 211 or see 211.org for local assistance on food, paying housing bills, accessing child care and other crisis help. Mental Health Help • Ohio Crisis Text Line Text keyword “4HOPE” to 741 741 • OhioMHAS Help Line 1-877-275-6364 • Find Substance Use Disorder and Mental Health Treatment https://findtreatment.gov • Disaster Distress Helpline 1-800-985-5990 1-800-846-8517 TTY o Text “TalkWithUs” to 66746 o Spanish-speakers: Text “Hablanos” to 66746 Available 24 hours a day, 7 days a week, year-round